Gas Networks Ireland outlines pathway to a net zero carbon network

11th September 2024

Challenges and opportunities for green hydrogen in a future energy system

11th September 2024Biomethane: A sustainable industry of scale

The publication of Ireland’s first major policy statement on biomethane marks an important milestone in an overarching ambition to develop a sustainable industry of scale by 2030.

In July 2023, the Environmental Protection Agency (EPA) highlighted the need for urgency to deliver decarbonisation options to meet the overarching target of 51 per cent reduction in emissions by 2030. The Government has subsequently acknowledged that without biomethane, Ireland is unlikely to meet its legally binding climate targets.

The National Biomethane Strategy is intended to be a starting point to catalyse the significant momentum required to produce 5.7 TWh of biomethane per annum by 2030, a target set by the Department of the Environment, Climate and Communications (DECC) in the context of the sectoral emissions ceilings.

The scale of the ambition is significant and challenging, and will require a shift from current production levels of less than 0.1 per cent of the State’s overall fossil gas demand to 10 per cent by 2030 – rising to over 50 per cent by the mid-2030s.

Recognition of the significant role biomethane will have in helping to decarbonise hard-to-abate sectors, including industrial heat and transport, can be seen by the shift of emphasis in increasing levels of production. The 5.7 TWh target for 2030 is more than three and a half times greater than the original target of 1.6 TWh outlined in Climate Action Plan 2019.

Co-developed by the Department of Agriculture, Food and the Marine (DAFM) and DECC, the strategy outlines 25 measures under a framework of five key pillars:

- sustainability;

- demand for biomethane;

- bioeconomy and circular economy;

- economics of biomethane; and

- enabling policy requirements.

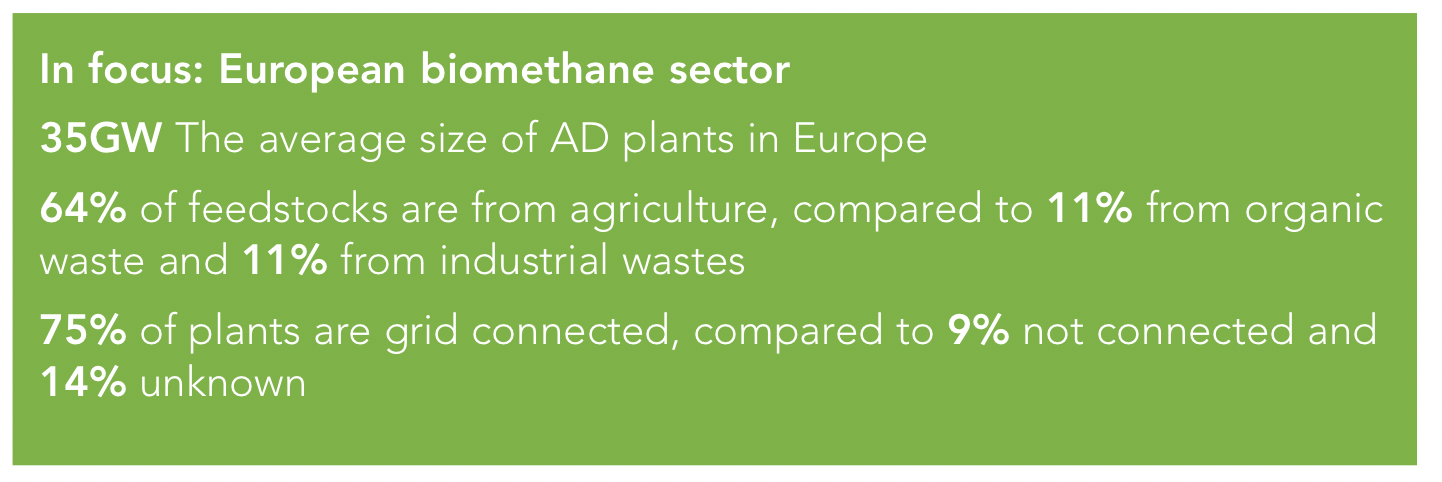

The production of biomethane is firmly established in Europe, with an estimated 37 TWh produced in 2022. However, it is described as being at a “nascent stage of development” in Ireland, despite recognition of its potential given the size of the agriculture sector here.

With only two operational biomethane facilities injecting biomethane into the gas grid, current direct injection is estimated to be around just 75 GWh per annum. Most of this is used within the transport sector under the Renewable Transport Fuel Obligation.

Biogas, produced through anaerobic digestion (AD) is only classed as biomethane when upgraded to methane with greater than 97 per cent purity, making it compatible with the national gas network. Alongside Ireland’s two biomethane plants, there are over 40 AD facilities which produce a total of 580 GWh of biogas.

Diversification

While much of the emissions savings of biomethane will be counted in the energy sector, there is a recognition that increased production offers alternative land use options for the agriculture sector. The sectoral emission ceiling for agriculture sets a need for a 25 per cent emission reduction between 2018 and 2025.

As such, according to the strategy: “The development of a biomethane industry will also provide significant opportunities to reduce emissions in agriculture and improve the likelihood of reaching the sectoral targets.

“These opportunities with biomethane for agriculture include diversification opportunities for livestock farmers, reduced emissions from animal wastes, biobased fertiliser replacing chemical fertiliser and carbon sequestration on land.”

Design

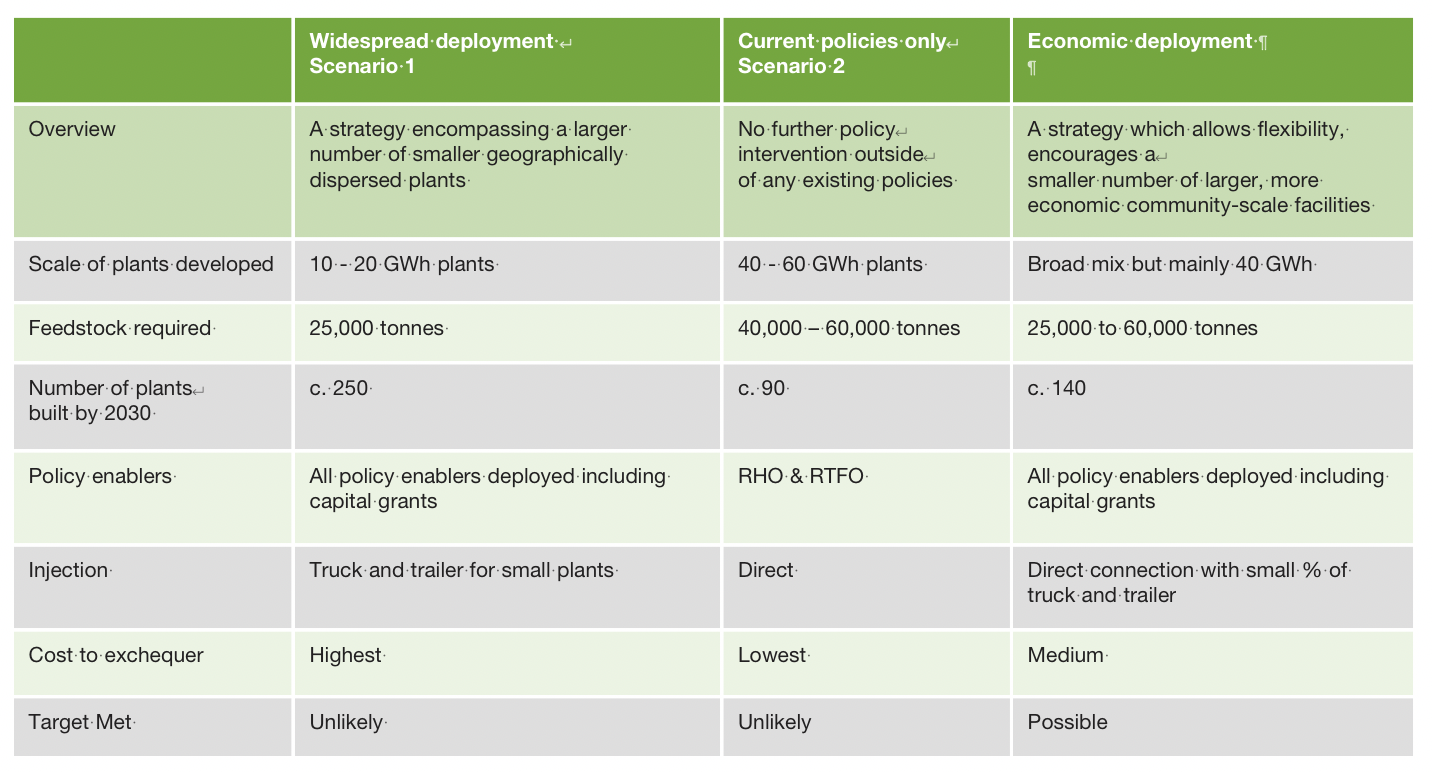

The Government has designed a bespoke AD model, focused on centralised, large-scale plants with grass silage and slurry as the main feedstocks. While the strategy suggests the need for a broad mix in the scale of plants developed, most of the focus will be on delivering plants that can produce 40 GWh of biogas, which come at an estimated cost of €15 million each.

Aiming for 1 TWh (1.7 per cent of current natural gas demand) of biomethane produced by the end of 2025, an estimated total of 25 40 GWh plants will need to be built .

The Government has secured €40 million from Europe’s REPowerEU scheme for a capital grant scheme for biomethane production plants and it is expected that AD plants currently operating to produce biogas will be eligible for capital support to upgrade their facilities to produce biomethane and other biobased products, along with new AD plants.

However, it is likely that only new plant builds with full planning and permitting permissions would be eligible for this round of capital support.

The strategy outlines that while a wide range of support mechanisms was assessed during the strategy’s development, the need to “swiftly stimulate” the industry led to the decision to utilise the Renewable Heat Obligation in conjunction with capital grants, which it says offers budget certainty for the support programme while delivering a sector of scale.

The Government has agreed to introduce a Renewable Heat Obligation by the end of 2024, which will obligate suppliers of fossil fuels used for heat to ensure a proportion of the energy they supply is renewable.

Given the evident challenge of access to finance, there is a recognition that smaller farmer-led/farmer-controlled projects will also need incentivised and supported. Although not confirmed, the Government is exploring the potential for an appropriate smaller-scale (circa 10 GWh plants) finance scheme and is expected to realise details before the end of 2024.

Sustainability charter

The Renewable Energy Directives set strict sustainability criteria for biomethane from AD plants to be classified as a zero-carbon renewable fuel, yet this only applies to facilities beyond 200 Nm3 /h of installed capacity. The Government has committed to developing a biomethane sustainability charter which will set similar guidelines for plants that fall outside the Directive’s threshold and will require compliance for eligibility for any potential financial support.

They include substantial GHG emissions savings calculated along the supply chain and the guarantee that biomass sourcing has a minimum impact on biodiversity and soil quality. Compliance with such criteria is necessary to qualify as renewable, to be eligible for any potential financial support, and to be zero-rated under the EU emissions trading system.

The charter will apply to all biomethane projects being developed in Ireland in receipt of any form of support or operating under the RHO and will, according to the strategy “support the delivery of environmentally sustainable biomethane in Ireland”.

Planning

Despite the recognised need for a rapid increase in AD plant development, there is no existing mechanism to fast-track applications. However, in response, the strategy commits to developing guidelines to support local authorities when assessing AD and biorefinery planning applications by the end of 2024.

Given the evident potential of biomethane production in Ireland, the strategy has been welcomed by stakeholders as a good first step towards developing an indigenous industry and reducing dependence on imported fossil fuels.

The strategy offers a blueprint of future progress and is a signal to prospective producers of the Government’s commitment to supporting and developing the industry.

Success will be determined by the ability of all stakeholders to deliver on the relevant key actions, within a short timeframe, and to ensure that financial support is sustained, particularly as other sectors strive towards their renewable targets.

Arguably most critical will be the buy-in achieved from the agri-food sector, and in particular farmers, who will provide feedstock for increasing number of plants. Minister for Agriculture, Food and the Marine Charlie McConalogue TD described the strategy as “agri-centric” and progress will rest on the commitment to enable farmers to contribute to the decarbonisation of Ireland’s energy system.